12, Nov

12, Nov

US Bitcoin Target: 50 EH/s Bitcoin Mining Capacity

While much of the Bitcoin mining industry is shifting towards AI and HPC infrastructure, American Bitcoin (NASDAQ: ABTC) has taken a very different approach: it aims to become a top Bitcoin miner, developing a massive BTC treasury, but remains committed to being more than just a miner or a passive BTC carrier. However, the core question remains: can its economics justify its ambitions when many of its peers are attempting to transition away from Bitcoin mining?

Let's take a closer look at their first quarterly earnings report as a Nasdaq-listed company.

Current Bitcoin Mining Status

The company was only founded on March 31, 2025, and went public on Nasdaq on September 3. It has moved swiftly within this short window.

As of the end of the third quarter, it reported approximately 25 EH/s of installed capacity, with an average fleet efficiency of 16.3 J/TH. A major contributor was exercising its option to procure approximately 14.8 EH/s of new mining rigs at its Vega, Texas site. Management's comments revealed a roadmap towards ~50 EH/s.

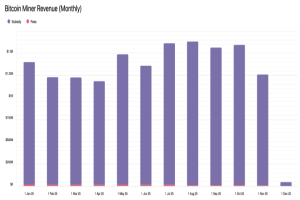

Screenshot from their investor presentation (page 12).

In the same brief window, it grew its Bitcoin reserves from zero on April 1st to 3,418 BTC on September 30th (at the time of writing, that figure has reached 4000+ BTC). Management converted this to 371 satoshis per share and emphasized that each BTC share has increased by approximately 50% since its IPO. They publicly hope the market will focus on each Bitcoin share as the primary value perspective, rather than just revenue or headline hashrate.

In summary, American Bitcoin has made a conscious, focused bet on expanding Bitcoin mining and BTC holdings, rather than transitioning away from these areas.

The asset-light model is their magic formula.

What makes American Bitcoin's Bitcoin mining business unique is its partnership with Hut 8. The company does not own any major infrastructure. Hut 8 develops and operates the sites, negotiates with utilities, and provides the physical environment for miners. American Bitcoin purchases and funds an ASIC fleet, pays for hosting and services, and focuses its capital on miners and Bitcoin rather than substations and buildings. In the third quarter, management stated that their SG&A accounted for approximately 13% of total revenue, a relatively lean cost base, consistent with the company's claim that not owning infrastructure helps keep fixed overhead low.