12, Nov

12, Nov

Bitcoin hash rate hits all-time low, network hashrate shows early signs of pullback.

This article comes from Theminermag, a trade publication for the cryptocurrency mining industry, focusing on the latest news and research on institutional Bitcoin mining companies.

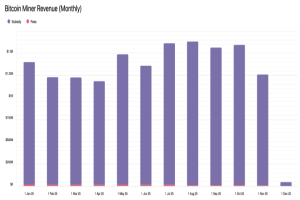

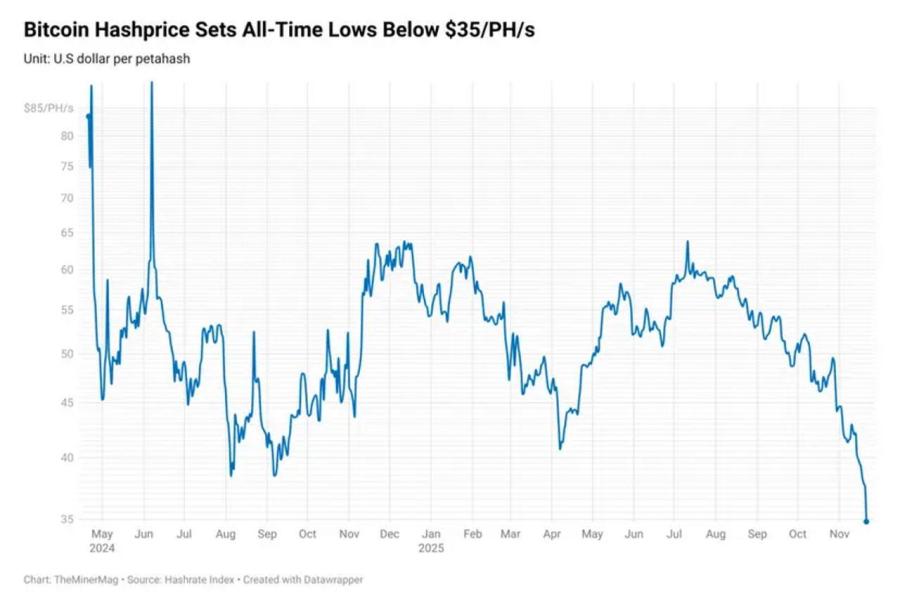

As of Saturday, BTC was trading near $83,000, down more than 30% from its all-time high last month. This drop has wiped out all gains so far this year and pushed mining economics further into losses. The decline comes at a time when record hashrate and difficulty levels were reached earlier this month, further reducing the number of Bitcoins miners can produce per unit of hashrate.

However, there are now early signs that miners are beginning to scale back. Bitcoin's seven-day moving average hashrate has dropped from approximately 1.124 Zeta hashes per second (ZH/s) in mid-November to approximately 1.06 ZH/s, suggesting that some operators may have begun disconnecting hardware as profit margins become tighter.

At the current block production rate, the network is expected to undergo a negative difficulty adjustment of about 2% within approximately four days. If the hashrate continues to decline in the coming days, the adjustment could deepen.

The recent contraction in mining profitability follows several months of low transaction fee revenue and the rapid expansion of computing power deployment after last year's halving, making operators more vulnerable to market-driven hash price fluctuations.